Every trading day, millions of investors face the same challenge: finding reliable, actionable market intelligence without drowning in information overload. The NASDAQ Composite Index alone comprises over 3,000 stocks, each generating constant streams of price data, news, and technical signals. For most investors, separating signal from noise feels impossible. This is where FintechZoom NASDAQ enters the picture—a platform designed specifically to cut through the complexity and deliver what traders and investors actually need: real-time insights, sophisticated analysis tools, and a community of informed market participants.

This comprehensive guide explores everything you need to know about FintechZoom NASDAQ in 2026. We’ll examine its core features, compare it against established competitors, analyze real-world use cases, and provide practical guidance for getting started. By the end, you’ll understand not just what FintechZoom NASDAQ is, but whether it’s the right platform for your specific investment goals and trading style.

What is FintechZoom NASDAQ? Understanding the Platform

FintechZoom NASDAQ represents the intersection of two powerful forces in modern finance: the NASDAQ stock exchange and financial technology innovation. To understand this platform fully, we need to unpack both components.

The NASDAQ Composite Index tracks the performance of all stocks listed on the NASDAQ exchange—a market known for its concentration of technology companies, biotech firms, and growth-oriented enterprises. Unlike the NYSE, which emphasizes established blue-chip companies, NASDAQ has become synonymous with innovation and disruption. Companies like Microsoft, Apple, Amazon, Tesla, and Nvidia call NASDAQ home. This concentration of cutting-edge businesses makes NASDAQ a barometer for technological progress and market sentiment around innovation.

FintechZoom, meanwhile, is a financial technology platform that aggregates market data, news, analysis, and trading tools into a single interface. The company’s mission centers on empowering both individual and institutional investors with information and tools previously available only to professional traders. When you combine NASDAQ’s market data with FintechZoom’s analytical capabilities, you get a specialized platform designed for investors interested in technology stocks and growth opportunities.

The platform serves a specific niche: investors who care deeply about NASDAQ-listed companies and want real-time intelligence to inform their decisions. This isn’t a generalist platform trying to cover every market globally. Instead, FintechZoom NASDAQ focuses intensively on what matters most to its core audience—the stocks, trends, and opportunities within the technology-heavy NASDAQ ecosystem.

Founded with the belief that market information should be accessible and actionable, FintechZoom has grown into a trusted resource for millions of users worldwide. The platform’s evolution reflects changing investor needs. As retail investing has exploded, as algorithmic trading has become mainstream, and as information moves at the speed of light, platforms like FintechZoom have become essential infrastructure for modern portfolio management.

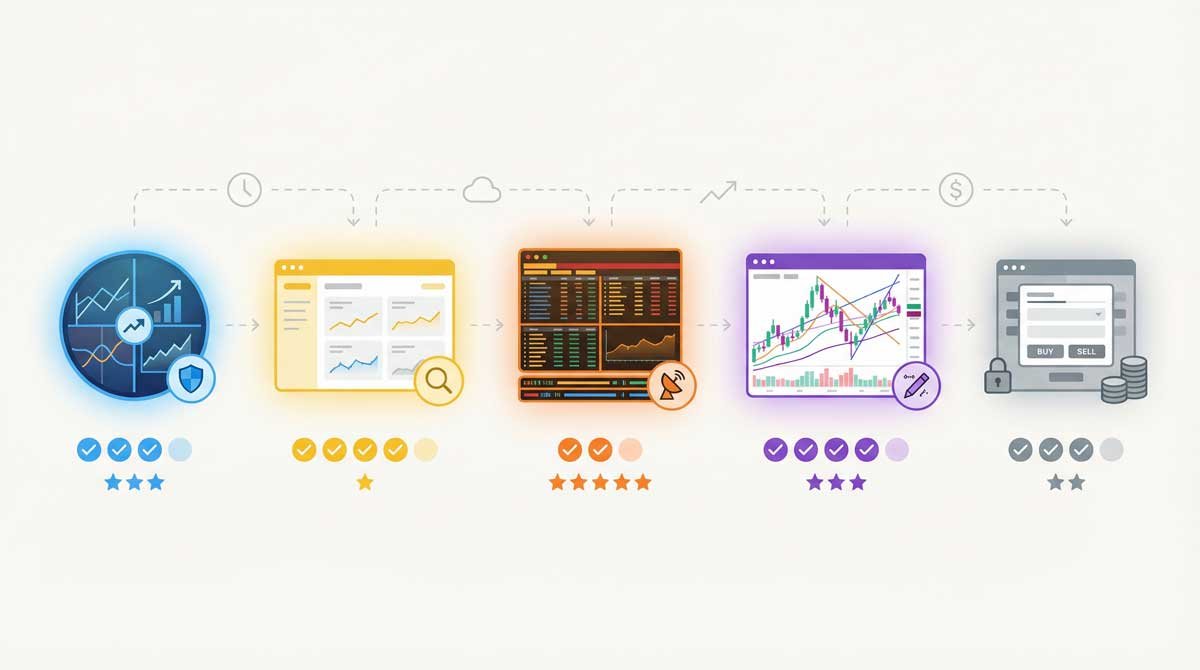

Essential Features and Tools That Matter

Understanding FintechZoom NASDAQ’s value requires examining the specific tools and features that set it apart. The platform isn’t just a data feed—it’s a complete ecosystem designed around investor needs.

Real-Time Market Data and Live Updates

At the platform’s core lies real-time market data. When you open FintechZoom NASDAQ, you see live stock prices updating continuously throughout the trading day. This isn’t delayed data from hours earlier. Every price movement, every volume spike, every earnings announcement appears instantly. For active traders, this real-time capability is non-negotiable. Missing a price movement by even seconds can mean the difference between profit and loss.

Beyond simple price quotes, the platform provides comprehensive market context. You can see intraday price movements, historical performance data, and key metrics like market capitalization, price-to-earnings ratios, and dividend yields. The platform tracks not just individual stocks but also the broader NASDAQ Composite Index itself, allowing you to understand how individual holdings perform relative to the overall market.

Advanced Technical Analysis Tools

Technical analysis—the practice of studying price charts and patterns to predict future movements—has become central to modern trading. FintechZoom NASDAQ provides a sophisticated charting suite that rivals professional-grade platforms.

The charting tools allow complete customization. You can adjust timeframes from one-minute candles to monthly views, overlay multiple technical indicators simultaneously, and save your preferred chart configurations for quick access. The platform includes essential indicators like moving averages, which smooth out price noise to reveal underlying trends. The Relative Strength Index (RSI) helps identify overbought and oversold conditions. MACD (Moving Average Convergence Divergence) signals momentum shifts. Bollinger Bands show volatility levels.

These aren’t academic tools—they’re practical instruments that traders use daily to make decisions. FintechZoom NASDAQ makes them accessible without requiring users to understand complex mathematical formulas. The platform handles the calculations; users focus on interpretation and strategy.

Cryptocurrency Coverage and Digital Assets

The line between traditional stocks and digital assets has blurred significantly. FintechZoom NASDAQ recognizes this reality by providing comprehensive cryptocurrency coverage alongside traditional equities. You can track Bitcoin, Ethereum, and hundreds of altcoins with the same real-time data and analytical tools available for stocks.

This integration matters because many NASDAQ-listed companies have exposure to cryptocurrency and blockchain technology. Understanding crypto market movements helps investors assess these companies’ prospects. Additionally, many traders maintain portfolios spanning both traditional and digital assets. Having both accessible through one platform reduces friction and improves decision-making.

Portfolio Management and Tracking

Building wealth requires more than identifying good investments—it requires tracking performance over time. FintechZoom NASDAQ includes portfolio management tools that let you monitor your holdings’ performance. You can see how your portfolio performs against benchmarks, identify your best and worst performers, and understand your overall asset allocation.

The platform also enables custom alerts. You can set notifications for specific price levels, volume spikes, or news events related to your holdings. This proactive monitoring helps you catch important developments without needing to constantly refresh your screen. For busy professionals juggling multiple responsibilities, these alerts provide essential peace of mind.

Educational Resources and Learning Center

The platform recognizes that knowledge gaps often hold investors back. FintechZoom NASDAQ includes extensive educational resources ranging from beginner tutorials to advanced trading strategies. You can learn about fundamental analysis, technical analysis, risk management, and portfolio diversification. The platform hosts webinars, publishes detailed guides, and maintains a community forum where users share insights and strategies.

This educational focus distinguishes FintechZoom from purely data-focused platforms. It acknowledges that investors don’t just need information—they need context and understanding. A beginner can progress from basic stock market concepts to sophisticated trading strategies entirely within the platform’s educational ecosystem.

How to Get Started: A Beginner’s Guide

Starting with FintechZoom NASDAQ needn’t be intimidating. The platform’s user interface prioritizes accessibility without sacrificing power. Here’s how to begin your journey.

Creating Your Account

The signup process takes minutes. Visit FintechZoom’s website and click the registration button. You’ll provide basic information: email address, password, and some profile details. The platform doesn’t require extensive verification for basic access—you can start exploring immediately. For features involving real money or advanced capabilities, additional verification becomes necessary, but initial exploration requires minimal friction.

Navigating the Platform Interface

Upon login, you’ll encounter the main dashboard. The interface organizes information logically. The top section displays major indices: NASDAQ Composite, S&P 500, and Dow Jones. Below that, you’ll find your personalized watchlist—stocks you’ve marked for monitoring. The main content area shows detailed charts, news feeds, and analysis tools.

Don’t feel overwhelmed by the interface’s capabilities. You don’t need to master every feature immediately. Start with the watchlist and charting tools. Add a few stocks you’re interested in. Spend time exploring the charts. Get comfortable with the basic navigation before diving into advanced features.

Setting Up Your Watchlist

Your watchlist becomes your command center. Rather than searching for stocks repeatedly, you can maintain a curated list of companies you’re monitoring. To add stocks, simply search for the ticker symbol and click “Add to Watchlist.” You can organize your watchlist into categories—perhaps separating tech stocks, dividend payers, and speculative positions.

As your watchlist grows, you’ll develop intuition about different stocks’ behavior. You’ll notice which ones move together, which ones react to specific news, and which ones follow broader market trends. This observational learning builds the foundation for better investment decisions.

Creating Price Alerts

Price alerts represent one of FintechZoom NASDAQ’s most practical features. Let’s say you’re interested in a stock trading at $150 but only want to buy if it drops to $140. Rather than checking the price constantly, set an alert. When the stock reaches your target price, you’ll receive a notification. This automation frees you from constant monitoring while ensuring you don’t miss opportunities.

You can set multiple alert types: price targets, percentage changes, or volume spikes. This flexibility accommodates different trading styles. Day traders might set tight alerts for minute-by-minute movements. Long-term investors might set monthly alerts for significant price changes.

Making Your First Trade

FintechZoom NASDAQ itself doesn’t execute trades—it provides the information and analysis. To actually buy or sell stocks, you need a brokerage account (which many users maintain separately). However, the platform integrates with major brokers, allowing seamless order execution directly from FintechZoom’s interface.

Before placing your first trade, ensure you understand what you’re buying. Review the company’s fundamentals: revenue, profit margins, competitive position. Study the technical chart. Consider your investment thesis—why do you believe this stock will appreciate? What could go wrong? This disciplined approach prevents impulsive decisions driven by emotion rather than analysis.

Common Beginner Mistakes to Avoid

New investors often fall into predictable traps. First, they chase performance—buying stocks that have already surged, hoping to catch the next big move. This typically results in buying high and selling low. Second, they overtrade, generating excessive fees and taxes while reducing returns. Third, they neglect diversification, concentrating their portfolio in a few positions and exposing themselves to unnecessary risk.

FintechZoom NASDAQ’s educational resources address these pitfalls directly. The platform encourages disciplined, research-based investing rather than speculation. Its tools support long-term wealth building rather than short-term gambling. Using the platform effectively means resisting the urge to act on every price movement and instead focusing on your long-term investment strategy.

FintechZoom NASDAQ vs. Competitors: A Detailed Comparison

The market for investment platforms has become crowded. Understanding how FintechZoom NASDAQ compares to alternatives helps you make an informed choice. Let’s examine the major competitors and how they stack up.

Yahoo Finance: The Generalist Alternative

Yahoo Finance has served investors for decades. It provides free stock quotes, news, and basic charting. For casual investors checking stock prices occasionally, Yahoo Finance suffices. However, it lacks the depth and specialization that serious traders require.

The key difference: Yahoo Finance aims for broad coverage across all markets globally. FintechZoom NASDAQ specializes intensively in NASDAQ and technology stocks. This specialization means FintechZoom provides deeper analysis, more sophisticated tools, and more relevant content for NASDAQ-focused investors. If you want comprehensive global market coverage, Yahoo Finance wins. If you want NASDAQ expertise, FintechZoom excels.

Yahoo Finance’s charting tools are basic compared to FintechZoom’s. The technical indicators are limited. The educational resources focus on general investing rather than advanced trading strategies. For beginners, this simplicity is fine. For active traders, it’s constraining.

Bloomberg Terminal: The Professional Standard

Bloomberg Terminal represents the gold standard for professional traders and analysts. It provides unmatched data depth, real-time news, and sophisticated analysis tools. Every major financial institution uses Bloomberg.

However, Bloomberg Terminal costs approximately $24,000 annually. This price point makes it inaccessible to individual investors. Additionally, Bloomberg’s complexity requires significant training. It’s designed for professionals who spend their entire day analyzing markets.

FintechZoom NASDAQ democratizes many Bloomberg capabilities at a fraction of the cost. While it doesn’t match Bloomberg’s comprehensiveness, it provides serious investors with professional-grade tools at consumer-friendly pricing. For individuals and small investment firms, FintechZoom offers superior value.

TradingView: The Charting Specialist

TradingView has become the go-to platform for technical analysis enthusiasts. Its charting tools are exceptional—arguably superior to FintechZoom’s. The platform supports thousands of technical indicators and allows custom indicator creation through Pine Script programming.

However, TradingView focuses almost exclusively on charting and technical analysis. It lacks the fundamental analysis tools, news integration, and educational resources that FintechZoom provides. TradingView also covers all markets globally, not specializing in NASDAQ.

The choice between TradingView and FintechZoom depends on your priorities. Pure technical traders might prefer TradingView’s charting superiority. Investors seeking a comprehensive platform balancing technical and fundamental analysis prefer FintechZoom.

Interactive Brokers: The Trading Platform

Interactive Brokers combines brokerage services with advanced trading tools. It allows direct stock trading alongside market analysis. For active traders who want everything integrated, Interactive Brokers appeals.

The tradeoff: Interactive Brokers’ interface is notoriously complex. New users find it overwhelming. The platform assumes significant trading knowledge. Additionally, Interactive Brokers charges commissions on trades, while FintechZoom provides free market data and analysis.

FintechZoom NASDAQ works well alongside Interactive Brokers. Use FintechZoom for research and analysis, then execute trades through Interactive Brokers. This combination leverages each platform’s strengths.

Comparative Feature Table

| Feature | FintechZoom NASDAQ | Yahoo Finance | Bloomberg | TradingView | Interactive Brokers |

|---|---|---|---|---|---|

| Real-Time Data | ✓ | ✓ | ✓ | ✓ | ✓ |

| Technical Analysis | Advanced | Basic | Advanced | Exceptional | Advanced |

| Fundamental Analysis | Good | Good | Excellent | Limited | Good |

| NASDAQ Focus | Specialized | Generalist | Generalist | Generalist | Generalist |

| Educational Resources | Extensive | Limited | None | Limited | Limited |

| Crypto Coverage | Yes | Yes | Yes | Yes | Limited |

| Price | Freemium | Free | $24,000/year | Freemium | Commission-based |

| Ease of Use | Good | Excellent | Difficult | Moderate | Difficult |

| Portfolio Tools | Yes | Yes | Yes | Limited | Yes |

This comparison reveals FintechZoom NASDAQ’s positioning: a specialized, accessible platform combining professional-grade tools with beginner-friendly design and strong educational resources. It doesn’t win on every dimension, but it excels at serving NASDAQ-focused investors at reasonable cost.

Security, Privacy, and Data Protection

Investing online requires trusting a platform with sensitive financial information. Understanding FintechZoom NASDAQ’s security practices is essential before committing your data and money.

Data Encryption and Security Infrastructure

FintechZoom NASDAQ employs industry-standard encryption protocols. All data transmitted between your device and FintechZoom’s servers uses HTTPS encryption, the same technology that protects banking websites. This encryption prevents unauthorized interception of your information.

The platform stores user data on secure servers with multiple layers of protection. FintechZoom implements firewalls, intrusion detection systems, and regular security audits. The company maintains compliance with major data protection standards including GDPR and CCPA, ensuring your data receives appropriate protection regardless of your location.

User Privacy Policies

FintechZoom’s privacy policy clearly outlines how user data is collected, used, and protected. The platform collects information necessary for account management and service improvement. This includes your profile information, trading history, and browsing behavior on the platform.

Importantly, FintechZoom does not sell user data to third parties for marketing purposes. This privacy-first approach contrasts with some free platforms that monetize user information. Your investment data remains confidential and under your control.

Account Security Best Practices

While FintechZoom provides robust security infrastructure, users bear responsibility for account protection. Use strong, unique passwords combining uppercase letters, lowercase letters, numbers, and special characters. Never share your password with anyone. Enable two-factor authentication if available—this adds an extra verification step when logging in from new devices.

Be cautious with phishing attempts. Scammers sometimes send fake emails impersonating FintechZoom, requesting login credentials or personal information. FintechZoom will never request passwords via email. If you receive suspicious communications, report them to FintechZoom’s security team rather than responding.

Risk Management Tools

Beyond security, FintechZoom NASDAQ provides tools for managing investment risk. Position sizing calculators help you determine appropriate trade sizes based on your account size and risk tolerance. Stop-loss order capabilities allow you to automatically exit losing positions at predetermined prices, limiting potential losses.

The platform also provides portfolio analysis tools showing your overall risk exposure. You can see how concentrated your portfolio is in specific sectors or individual stocks. This visibility helps prevent excessive concentration risk—the danger of having too much capital in too few positions.

Regulatory Compliance

FintechZoom operates under regulatory oversight. The platform complies with SEC regulations governing investment platforms and financial data providers. This regulatory framework provides investor protection and ensures the platform operates transparently and ethically.

However, it’s important to understand that FintechZoom is not itself a brokerage or investment advisor. It provides tools and information but doesn’t manage money or provide personalized investment advice. Users remain responsible for their own investment decisions. This distinction matters legally and practically—it means FintechZoom’s liability is limited to providing accurate data and functional tools, not to investment outcomes.

Real-World Use Cases and Success Stories

Understanding how different investors use FintechZoom NASDAQ reveals the platform’s versatility. These scenarios represent common user profiles.

Case Study 1: The Day Trader

Marcus is a full-time day trader who executes 10-20 trades daily, typically holding positions for minutes to hours. His success depends on identifying short-term price movements and exploiting them before the market corrects.

Marcus uses FintechZoom NASDAQ’s real-time data and technical analysis tools extensively. He monitors multiple NASDAQ stocks simultaneously, watching for specific chart patterns that historically precede price moves. When he identifies a setup matching his trading criteria, he executes a trade through his brokerage, often exiting within minutes.

The platform’s price alerts help Marcus stay informed without staring at screens constantly. He sets alerts for key technical levels, allowing him to focus on analysis while the platform notifies him of important price movements. FintechZoom’s charting tools enable the rapid technical analysis his trading style requires.

Marcus also uses FintechZoom’s educational resources to continuously refine his trading strategies. He studies historical price patterns, learns new technical indicators, and participates in the community forum where other traders share insights. This continuous learning has improved his win rate and reduced his losses.

Case Study 2: The Long-Term Investor

Sarah is a 35-year-old professional building wealth for retirement. She invests monthly in a diversified portfolio of NASDAQ stocks, planning to hold for 20+ years. Her investment style emphasizes fundamental analysis—understanding companies’ competitive advantages, financial health, and growth prospects.

Sarah uses FintechZoom NASDAQ to research companies before investing. She reviews fundamental metrics like revenue growth, profit margins, and return on equity. She reads company news and analyst reports available through the platform. She studies long-term price charts to understand how stocks have performed through different market cycles.

The platform’s portfolio tracking tools help Sarah monitor her holdings’ performance. She sees how her portfolio has grown over time and identifies which positions have contributed most to her returns. This data informs her rebalancing decisions—when to add to winning positions and when to trim underperformers.

Sarah appreciates FintechZoom’s educational resources focused on long-term investing. She’s learned about diversification, asset allocation, and managing portfolio risk. These principles have helped her maintain discipline during market volatility, resisting the urge to panic-sell during downturns.

Case Study 3: The Curious Beginner

James is a 28-year-old who recently decided to start investing. He has minimal financial knowledge but is committed to learning. He’s intimidated by the complexity of stock markets but recognizes that investing is essential for building long-term wealth.

James started with FintechZoom NASDAQ’s beginner tutorials. He learned basic concepts: what stocks are, how markets work, what diversification means. He progressed to more advanced topics: technical analysis, fundamental analysis, risk management. The platform’s educational approach—starting simple and building complexity—suited his learning style perfectly.

James began with a small portfolio of well-known NASDAQ companies: Apple, Microsoft, Amazon. He used FintechZoom’s charting tools to understand how these stocks move. He set price alerts to stay informed without obsessing over daily fluctuations. Over months, his confidence grew.

Now, after a year of learning and investing, James has developed genuine investment knowledge. He understands his portfolio’s composition, can analyze new investment opportunities, and makes disciplined decisions based on research rather than emotion. FintechZoom NASDAQ played a crucial role in this transformation from financial novice to informed investor.

Common Success Factors

These diverse use cases share common elements. Successful users treat FintechZoom NASDAQ as a learning tool, not just a data source. They use the platform’s educational resources to continuously improve their knowledge. They maintain discipline, following predetermined strategies rather than reacting emotionally to price movements. They leverage the platform’s tools systematically rather than randomly exploring features.

Additionally, successful users recognize FintechZoom’s role in their broader investment strategy. They understand it’s one tool among many—valuable for research and analysis but not a substitute for personal judgment and responsibility.

2026 Updates: New Features and AI Integration

The investment technology landscape continues evolving rapidly. FintechZoom NASDAQ has introduced significant updates in 2026 that enhance its capabilities and user experience.

AI-Powered Market Analysis

The most significant 2026 update involves artificial intelligence integration. FintechZoom now uses machine learning algorithms to analyze massive datasets and identify patterns humans might miss. These AI systems analyze historical price data, news sentiment, earnings reports, and macroeconomic indicators to generate market insights.

The AI doesn’t make investment recommendations—that remains users’ responsibility. Instead, it surfaces relevant information and patterns. For example, the AI might identify that certain stocks historically surge following specific types of earnings announcements, or that particular technical patterns precede price moves with high statistical probability.

This AI integration democratizes analysis previously available only to institutions with massive computational resources. Individual investors can now access insights derived from analyzing billions of data points.

Enhanced Mobile Application

FintechZoom’s mobile app has been completely redesigned for 2026. The new interface prioritizes usability on small screens while maintaining access to sophisticated tools. Users can now execute complex technical analysis on smartphones, receive real-time alerts, and manage portfolios on the go.

The mobile app includes offline functionality—you can download charts and data for analysis without internet connectivity. This feature appeals to traders who travel or work in environments with unreliable connectivity.

API and Integration Capabilities

FintechZoom has opened API access, allowing developers to build custom applications using FintechZoom data. This enables sophisticated users to create automated trading systems, custom dashboards, and specialized analysis tools. The API access opens possibilities for algorithmic trading and advanced portfolio management.

Expanded Cryptocurrency Integration

Cryptocurrency coverage has expanded significantly. FintechZoom now provides advanced charting and analysis tools for crypto assets matching those available for stocks. The platform tracks thousands of cryptocurrencies and tokens, providing the same real-time data and technical analysis capabilities.

This expansion reflects the growing importance of digital assets in diversified portfolios. Many NASDAQ companies have cryptocurrency exposure, and many investors maintain crypto holdings alongside traditional stocks. Integrated coverage simplifies portfolio management.

Community Features and Social Trading

FintechZoom has introduced community features allowing users to share trading ideas, discuss market developments, and learn from each other. Users can follow experienced traders, see their portfolios, and understand their investment rationale. This social element creates accountability and accelerates learning for newer investors.

These updates position FintechZoom NASDAQ as a forward-looking platform embracing technological innovation while maintaining its core focus on accessibility and user education.

Frequently Asked Questions About FintechZoom NASDAQ

Conclusion and Call to Action

FintechZoom NASDAQ represents a significant evolution in investment technology. It democratizes access to professional-grade market analysis tools, combines them with comprehensive educational resources, and packages everything in an accessible interface. Whether you’re a curious beginner taking your first steps into investing or an experienced trader seeking specialized NASDAQ tools, FintechZoom offers genuine value.

The platform’s 2026 updates—AI-powered analysis, enhanced mobile capabilities, expanded cryptocurrency integration, and community features—position it at the forefront of investment technology innovation. These additions don’t just add features; they fundamentally improve how investors research, analyze, and execute their strategies.

The investment landscape has democratized. Information that once required expensive subscriptions and specialized knowledge is now accessible to anyone with internet access. FintechZoom NASDAQ exemplifies this democratization. The platform empowers individual investors to compete with institutional traders by providing equivalent information and analytical tools.

However, tools alone don’t guarantee investment success. FintechZoom NASDAQ’s true value emerges when combined with disciplined investing principles: thorough research before investing, diversification to manage risk, long-term perspective to weather volatility, and continuous learning to improve your skills. The platform supports these principles through its design, features, and educational resources.

If you’re serious about investing in NASDAQ stocks and technology companies, FintechZoom NASDAQ deserves your attention. Start with the free tier to explore features and learn the platform. Progress to premium features if you find yourself needing advanced capabilities. Most importantly, commit to continuous learning. The investment knowledge you develop will serve you far longer than any platform features.

Ready to take control of your investment future? Visit FintechZoom’s website today and create your free account. Explore the charting tools, review the educational resources, and begin building the investment knowledge that leads to long-term wealth creation. The best time to start investing was years ago. The second-best time is today.

Your financial future depends on the decisions you make now. Make them informed. Make them disciplined. Make them with FintechZoom NASDAQ.

Leave a Reply